For U.S. Citizens who are Expats living outside the USA, sometimes one can get into a situation where the IRS says you owe them money. What to do? Well, first, it’s always best practice to deal with it straight on.

Now being an Expat gives you certain leverage that US Citizens who live within the USA do NOT have. For example, if all or some of your assets are in the USA, then, for the IRS, it’s just a push button away for them to confiscate your assets to settle the bill. However, if all your assets are NOT in the USA, it is very difficult for the IRS to get their hands on it. (not impossible but a lot more involved for them). So the confiscation pressure angle is harder for them to work. And you can use that arm’s length to buy you more time.

But the truth is, it’s best to settle it clean. You never want lingering issues with the US government. Besides, this fact does NOT absolve you from paying because, if that’s what you owe, then it is always best practice to get it settled. Keeping a clean record with the USA is always a good idea and it will keep your access to their services always in good steed which is down-the-road good advice.

Now, the best, most inexpensive way the IRS allows you to easily settle with them is what is called an “OFFER IN COMPROMISE” (OIC). Below I explain and then outline it for you.

So let’s get started…

An Offer in Compromise (OIC) is a program offered by the Internal Revenue Service (IRS) that allows taxpayers to settle their tax debts for less than the full amount they owe. It is designed for those who are unable to pay their tax liability in full or if paying it would create financial hardship. Here’s how you can go about making an Offer in Compromise:

1. Determine Eligibility

The IRS will generally accept an offer in compromise if they believe that the amount you are offering represents the most they can expect to collect within a reasonable period. They evaluate based on:

- Ability to pay

- Income

- Expenses

- Asset equity

You may be eligible if:

- You can’t pay your full tax debt, or doing so would cause financial hardship.

- You have filed all your required tax returns.

- You have made any required estimated tax payments.

- You are not in an open bankruptcy proceeding.

Use the IRS Offer in Compromise Pre-Qualifier Tool on their website to check if you qualify.

2. Submit the Offer

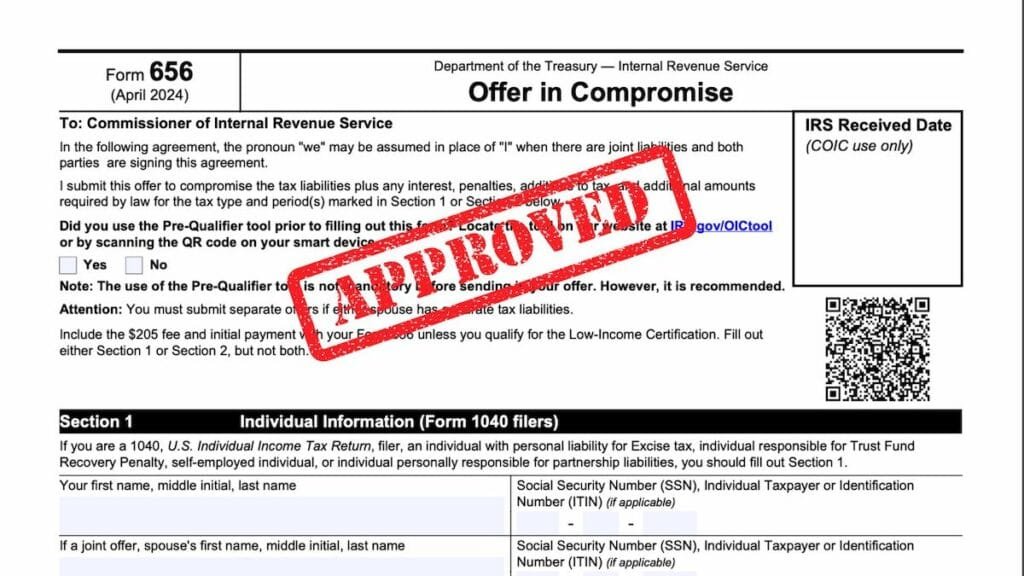

- Form 656: This is the formal Offer in Compromise form.

- Form 433-A (OIC) or Form 433-B (OIC): These forms collect information about your income, expenses, and assets. Form 433-A is for individuals, and Form 433-B is for businesses.

- Application Fee: There’s a non-refundable $205 application fee unless you qualify for a low-income exception.

The offer amount can be based on a lump sum payment or a periodic payment plan:

- Lump Sum Offer: You submit an initial payment of 20% of the total offer amount along with the application, and the balance is paid within 5 months of acceptance.

- Periodic Payment Offer: You make the initial payment and continue making monthly payments while the IRS evaluates your offer. If accepted, payments will continue as agreed upon in the offer.

3. Complete the Offer Package

Your offer package should include:

- Form 656 (the offer form)

- Form 433-A (OIC) or 433-B (OIC) (for financial disclosure)

- Supporting documentation like bank statements, asset valuations, and proof of income.

- Application fee ($205 unless exempt) and initial offer payment.

Find forms to submit an application and step-by-step instructions in Form 656-B, Offer in Compromise Booklet PDF.

4. Send the Offer

Mail your offer to the IRS address listed on Form 656, depending on where you live. You’ll find the appropriate IRS center listed in the form’s instructions.

5. IRS Review Process

The IRS will review your offer, and this can take several months. They may:

- Accept the offer: If the IRS agrees with your offer amount.

- Reject the offer: If they believe you can pay more than what you offered.

- Request more information: They might need more financial documentation.

If rejected, you have the option to appeal within 30 days using Request for Appeal of Offer in Compromise, Form 13711 PDF.

6. Make Payments

If your offer is accepted, follow the payment plan as agreed. Failure to meet the payment terms may result in the cancellation of your OIC.

7. Comply with Future Tax Obligations

After your offer is accepted, you must comply with all filing and payment requirements for the next five years. Failure to do so could void the offer, and the IRS may reinstate your original debt.

Important Tips:

- Be truthful and thorough in your financial disclosures.

- Consider getting advice from a tax professional, such as a CPA, tax attorney, or enrolled agent, especially if your case is complex.

- Use the IRS pre-qualifier tool to gauge your eligibility before submitting an offer.

The OIC is not guaranteed, but it offers a chance to settle your tax debt if you can prove financial hardship.

Once you get this settled, you can go back to enjoying your Expat life without worry or concern. Keep all things clean and easy and paradise on earth is yours! I hope this helps!

Charles Bivona Jr., aka Coach JP Money, is a business strategist, financial coach, and founder of CoachJPmoney.com. A lifelong entrepreneur, he launched his first real estate deal at 17 and went debt-free by 1998. Since then, he has built national media brands, advised small businesses, and helped clients grow online using smart strategy, digital tools, and creative grit.

An expat living in Baja, Mexico, Charles also writes and produces music as Johnny Punish and lives off-grid at Hacienda Eco-Domes, a sustainable retreat he built with his wife. Through providing small business services, coaching, writing, and podcasting, he’s on a mission to help others win their future—on their terms.

Read his full bio at PunishStudios.com >>>

Post Views: 66