In 1980, I was a broke 17-year-old with no home, no savings, and no clear direction for my future. That’s when I stumbled upon a life-changing opportunity—Robert Allen’s Nothing Down book.

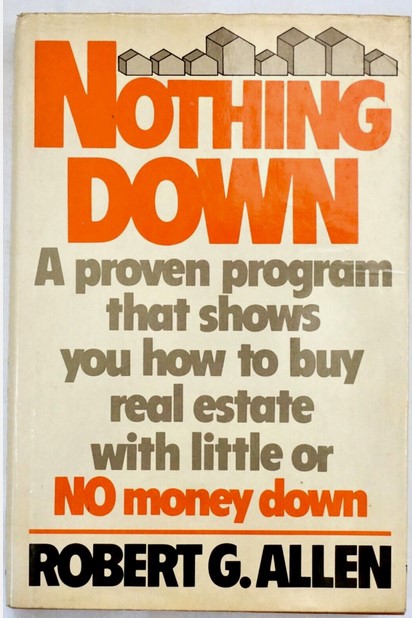

The book that started it all: Robert G. Allen’s Nothing Down showed me how to buy real estate without money upfront. Robert Allen’s Nothing Down promised a path to homeownership with no money out of pocket. It sounded too good to be true, but with nothing to lose, I bought the book for $2 and shared it with my cousins, Rich and Bill. The rest is history…

The book that started it all: Robert G. Allen’s Nothing Down showed me how to buy real estate without money upfront. Robert Allen’s Nothing Down promised a path to homeownership with no money out of pocket. It sounded too good to be true, but with nothing to lose, I bought the book for $2 and shared it with my cousins, Rich and Bill. The rest is history…

Allen claimed you could buy a home with no money down, and while it sounded far-fetched, I figured, “What do I have to lose?” So, I spent $2 to buy the book, and it was one of the best investments I’ve ever made.

I shared the book with my cousins, Rich and Bill. The three of us were broke college kids with big dreams but no capital. Determined to turn this idea into reality, we read the book cover to cover and followed its principles to the letter.

Within a year, together as one team (tenants-in-common), we owned a 3-bedroom, 2-bath home in Las Vegas. The price? $64,000. Our down payment? Absolutely nothing.

How We Did It: Creativity, Leverage, and Negotiation

Our strategy was simple but bold. Using the free house phones at Caesars Palace (back when that was a thing), we cold-called homeowners to find opportunities. Eventually, we came across a recently divorced young mother who needed to sell her home. She had an assumable mortgage of $44,000 at 7.25% interest—a manageable $250 monthly payment.

Here’s how we structured the deal:

- We assumed her $44,000 mortgage.

- We gave her a $20,000 promissory note at 10% interest, with a balloon payment due in five years.

With escrow opened and terms agreed upon, we took possession of the home. Then we rented it out for $600 a month. After collecting the first and last month’s rent upfront, we had $1,200 in hand—cash flow from day one!

We rented the property for several years before selling it, making a modest profit. While I can’t recall the exact figures now, the experience was priceless. We turned nothing into something, all thanks to creativity, fearlessness, and the power of leverage.

Las Vegas in the early 1980s

Las Vegas in the early 1980s

The Lesson: Success is Negotiated

This story isn’t just a nostalgic trip down memory lane; it’s a testament to an essential truth: Everything is owned or controlled by someone else. If you want a piece of the pie, you’ll need to negotiate for it—and leverage is your best friend.

Here’s what we did right:

- Creativity: We used free resources, like casino phones, to create opportunities.

- Leverage: With no money to our names, we relied on the assumable mortgage and a promissory note to finance the deal.

- Action: We didn’t wait for perfect conditions or guarantees; we simply went for it.

Why This Matters for You

You don’t need money to start building wealth—you need resourcefulness and courage. Whether it’s buying your first home, starting a business, or negotiating a raise, the principles are the same:

- Find opportunities others overlook.

- Use what you have to secure what you want.

- Act boldly, even when the outcome isn’t guaranteed.

If a broke 17-year-old could negotiate a house purchase in 1980, imagine what you can achieve today with the tools, information, and resources available at your fingertips. So, what’s stopping you?

[the_ad id=”2204″]

** Since this true story is over 40 years old, I have asked my cousin Rich to read it and correct anything I may have gotten incorrect or add stuff that I may have not remembered. I await his confirmation.

Charles Bivona Jr., aka Coach JP Money, is a business strategist, financial coach, and founder of CoachJPmoney.com. A lifelong entrepreneur, he launched his first real estate deal at 17 and went debt-free by 1998. Since then, he has built national media brands, advised small businesses, and helped clients grow online using smart strategy, digital tools, and creative grit.

An expat living in Baja, Mexico, Charles also writes and produces music as Johnny Punish and lives off-grid at Hacienda Eco-Domes, a sustainable retreat he built with his wife. Through providing small business services, coaching, writing, and podcasting, he’s on a mission to help others win their future—on their terms.

Read his full bio at PunishStudios.com >>>

Post Views: 78