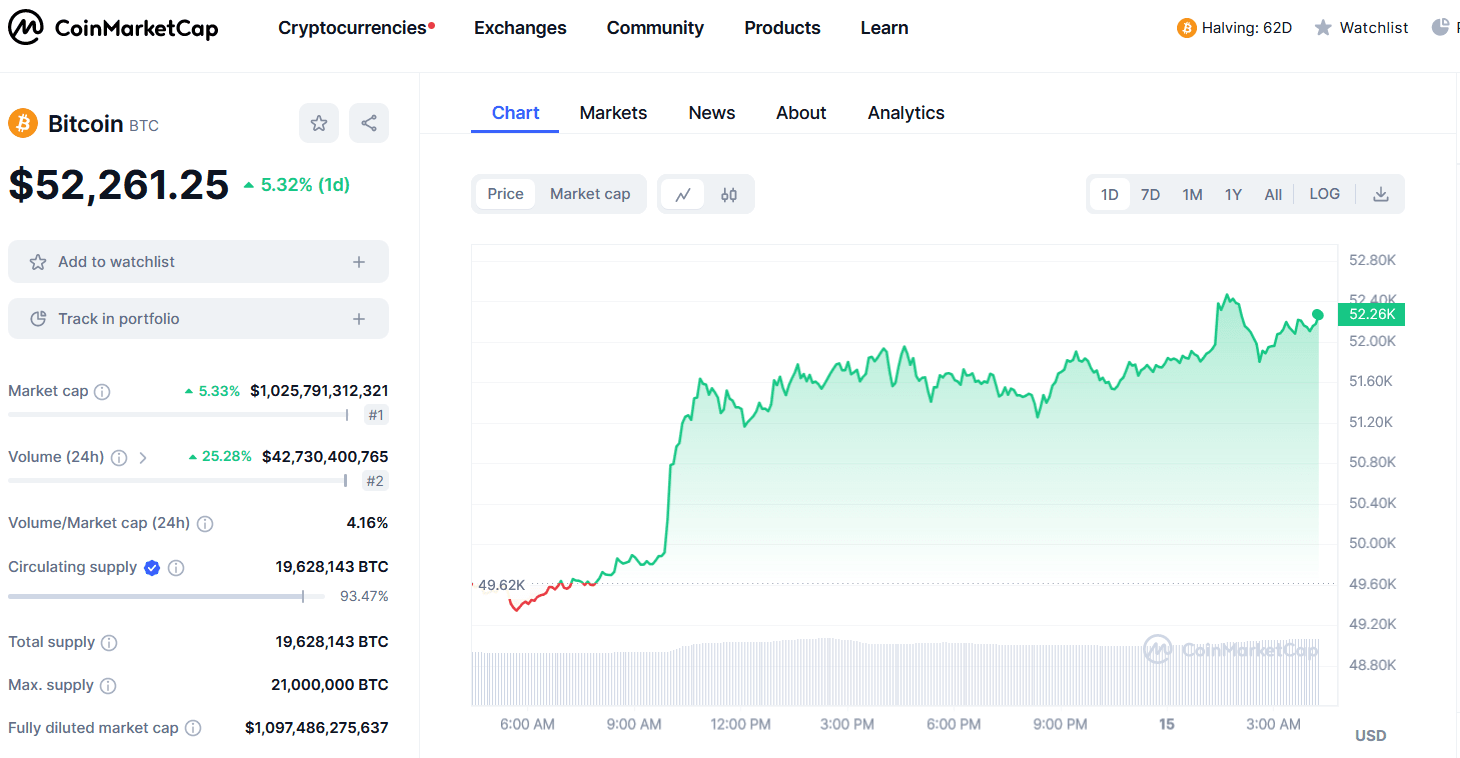

This morning I woke up in my Paris flat to find Bitcoin breaking above $ 52,000. Clearly, the $ 50,000 threshold has been vanquished. When I posted this on Facebook, I immediately got DM’s asking me why I did NOT tell my friends about Bitcoin and if it was too late to get in. (Click for Current Bitcoin Price)

Well, the answer is NOT simple. You see, mostly they are asking me this question because they are seeing huge rises in Bitcoin and want the quick hit. They see the crowds gaining and want to go to that party now!

Well, for thrillseekers and partygoers, I cannot advise. I am way too boring of an investor. In fact, one of my SECRET WEALTH TIPS learned over the decades from mentors and other successful investors is the following:

Well, for thrillseekers and partygoers, I cannot advise. I am way too boring of an investor. In fact, one of my SECRET WEALTH TIPS learned over the decades from mentors and other successful investors is the following:

Buy Quality Assets, Hold Long-Term! Simple!

I know, I know! It’s boring for thrillseekers. They hate it! They want action! They want that Las Vegas jackpot moment! They want their cash and they want it now! But the truth is, investing in wealth building is very boring. There is no daily exciting action. It’s not the dose one gets from day trading. But as a wealth-building strategy, it’s very effective and creates power.

In fact, the wealthy NEVER sell quality assets. When they see another great asset to buy, they just borrow against their other quality assets and buy more quality assets. And the wealth keeps building up.

So is it too late to buy Bitcoin? No, of course not! I mean, it’s a high-quality asset. And if you’re in it for the long run as a store of value, yes, dollar cost average it into your portfolio over time.

Ideally, if you understand how it all works and are comfortable, buy it on an exchange and own the Bitcoin directly. However, if you’re more of a casual investor and tend not to want to be directly involved, then just buy the ETF with your favorite brokerage house. The EFT is less stressful and they will hold the Bitcoin. It’s not ideal for freedom lovers because owning an ETF position is confiscatable and that’s diametrically opposite of the purpose of Bitcoin. But it works and will work just fine for probably 90% of investors.

But if you are a thrill seeker and crowd follower, don’t buy in! You’ll lose money. You will buy in, get mad when it drops a few grand. You will panic and sell. That’s not how this game works.

Wealth building requires you to buy and hold for a very long time.

For me, I hold in perpetuity. I have ZERO interest in selling Bitcoin! And I mean ZERO! If I was younger and more aggressive, I would borrow against it to buy more Bitcoin and accumulate a lot over time.

In fact, borrowing against quality assets NEVER triggers a capital gain tax. Instead, one is allowed to write off the interest on the loan. LOL! Yep, it’s a winner all the way around. Of course, you’ll need to check your own country’s tax law to see if this also works for you.

Nevertheless, at my age, borrowing huge amounts to buy more Bitcoin is not necessary. I already have all I want and I am NOT a megalomaniac. For me, I just want to continue to build wealth over time so that our family remains strong financially and can meet all financial challenges moving forward.

So it depends on the individual and goals. I hope that makes cents!

Sources: YT

Charles Bivona Jr., aka Coach JP Money, is a business strategist, financial coach, and founder of CoachJPmoney.com. A lifelong entrepreneur, he launched his first real estate deal at 17 and went debt-free by 1998. Since then, he has built national media brands, advised small businesses, and helped clients grow online using smart strategy, digital tools, and creative grit.

An expat living in Baja, Mexico, Charles also writes and produces music as Johnny Punish and lives off-grid at Hacienda Eco-Domes, a sustainable retreat he built with his wife. Through providing small business services, coaching, writing, and podcasting, he’s on a mission to help others win their future—on their terms.

Read his full bio at PunishStudios.com >>>

Post Views: 64